In September of 2015 I made the mistake of getting involved with a company called Trend Financial in Toronto Ontario. I had set to purchase what I expected was a reasonably priced, good quality vehicle that was in pretty good mechanical condition. Unfortunately this is not how companies like Trend financial operate. Far from it.

Due to a previous insurance claim, Trend Financial had $6,500 of my money which they were using to put as a deposit on my new vehicle. The vehicle was $11,000 so I had over 50% down payment. When I arrived in Toronto to pick the vehicle up it was in a terrible state of disrepair. The following things were broken on the vehicle:

– Missing parts of the vehcile (hand grips in the cab, buttons in the cab, etc.)

– Leaking diesel fuel

– non-stop beeping in cab

– Airbags malfunctioning

– back-up sensors malfunction

– steering wheel missing buttons

– cruise control not working

– marker lights malfunctioning

But worry not, I was told! All of these problems would be repaired if I would just take the vehicle to a garage. No charge to me, they promised.

After having to sign no less than 7 different lease agreements because of never-ending mess-ups by the sales person, the vehicle was mine. Or so I thought. All I had to do was take it home, and then get the vehicle repaired.

Of course this never happened.

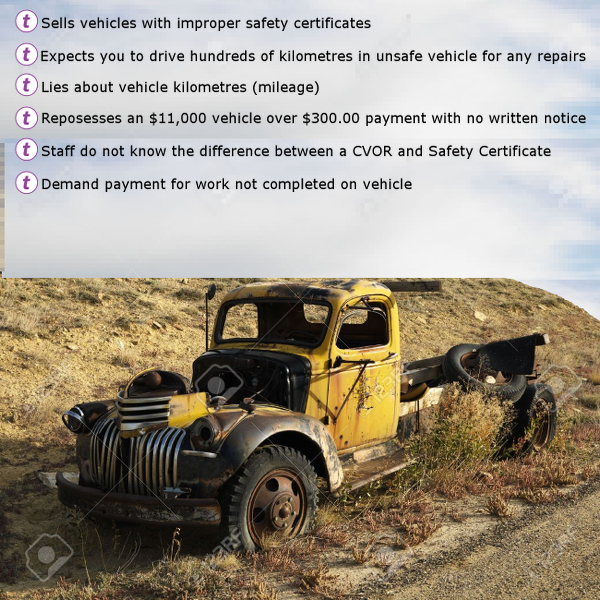

First off, the company lied about the kilometres of the vehicle. They advised me it was 178,000km and it ended up being over 300,000km and they had no explanation as to why. The only thing the sales person could come up with was “It’s an American truck, maybe it was miles”. Then of course was advised that I didn’t have to buy the vehicle, they would be happy to keep my $6,500 leftover from the insurance company. If I didn’t take the vehicle, I risked loosing a considerable amount of money.

Then I was advised I had to drive over 240km from my home to get the vehicle repaired. 240km! I lived next door to a certified garage, but they expected me to drive 240km to get the “free” repairs done on the vehicle. I sucked it up and drove the vehicle to the garage, and only a couple of the minor problems were repaired. At least it no longer was an environmental hazard and did not leak diesel after the first set of repairs. I was expected to bring the vehicle back 3 more times and risk getting a bunch of tickets to get the repairs for “free”.

I asked Trend Financial multiple times to get the vehicle repaired at a garage in my city, and was constantly denied. Trend expected me to drive an unfit vehicle 240km in unsafe condition. This would risk the life and my family so they could save a couple of dollars.

Eventually I was pulled over at a commercial truck weigh scale and given a verbal warning. Apparently the truck had a loose exhaust system, missing marker light, AND an improper safety certificate.

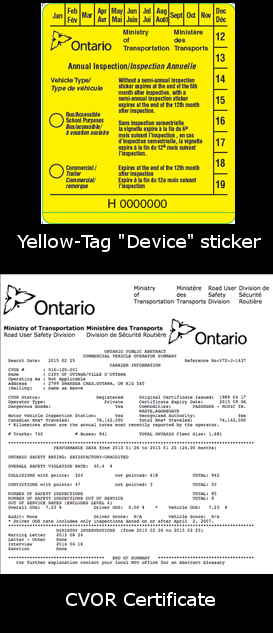

In Ontario, Canada any vehicle over 4,500kg is required by law to have a commercial yellow-tag safety certificate and inspection. It’s a different and more strict safety certificate than normal cars and pick-up trucks get.

Trend Financial of course did not believe the vehicle needed this safety certificate and outright refused to get the vehicle the proper safety certificate the vehicle needed to be legal on the road. They flat out refused to follow the letter of the law due to their sheer ignorance about the products they sell. The uneducated people at Trend confused something called a “CVOR” or Commercial Vehicle Operators Record with Commercial yellow-tag safety certificate. A CVOR is something that commercial tractor-trailer drivers have that keeps a record of any infractions they get when they drive. A yellow-tag safety certificate is not remotely related.

Places like the Ontario Motor Vehicle Industry Council (OMVIC) are never any help. They normally side with the vendor and work hard to prove the customer is wrong. Either way, OMVIC has no actual power, they are just a bureaucratic agency.

Trend Financial had the nerve to tell me that the copies of the Ontario Highway Traffic Act information was incorrect. Without the truck being impounded by the Ministry of Transportation, they would not believe the officers at the weigh scale station that the truck was unsafe. I would be out my vehicle, and my money, just to satisfy the needs of the finance company. The weigh scale officers stated if the finance company gets the truck impounded at the weigh scale, they are under no legal obligation to give it back to me. I would be out my money, and my vehicle, and still be expected to pay the finance company back for it.

Along with selling an unsafe, unfit vehicle and expecting the person who bought it to drive it hundreds of kilometres in that condition, Trend didn’t stop there.

As with all purchases, Trend Financial asked me for a voided cheque to take bi-weekly payments out of the bank. This was more than reasonable.

However, the company then decided to enter the banking information wrong in their computer, and the first payment was marked as “returned” – even though I had nothing to do with this mistake. Of course Trend Financial charged me late fees, and threatened me with repossession on the phone because of their mistake.

Quite a few months later, one payment was returned (life happens, sometimes). Due to Trends initial incompetence, they felt this made me two payments behind for a grand total of $300.00

The unscrupulous company decided, without any attempt to contact me by phone, e-mail, or registered letter to attempt to repossess the vehicle. I found out because the tow truck company called me and advised me they would be coming in 24 hours if I did not get the situation resolved.

Again, the tow truck company called me. Why did the finance company not attempt to resolve the issue beforehand? The reason: they do not legally have to.

A quick call to my lawyer revealed the company can repossess the vehicle, sell it the same day, and force me to pay the balance. I may have no opportunity to get the vehicle back, even though the issue was partially the fault of Trend Financial.

The vehicle was not repossessed, repaired, or any resolve of this issue. However Trend charged me for the repossession, even though it did not happen. You read that correct, they charged me for work not completed.

Over $1,000 later I was able to keep the pile of garbage they sold me, and am able to drive to work and make money to keep my house, buy groceries, etc. Without the vehicle I would be unable to make money to live. Trend knows this, and will do everything that is legal (which is a lot) to take your money and their vehicle back at every opportunity. They constantly demonstrate they want to sell scrap, take your money, and leave you with nothing.

The kicker to all of this is: Not having a clue as to what MTO paperwork means while selling cars is legal. Selling broken down junk with improper safety certificates is completely legal. Being disrespectful to customers is legal. Making customers drive thousands of kilometres without compensation to get repairs is legal. Repossessing a vehicle that’s almost paid off over a couple hundred dollars is completely legal. Not giving notice before taking action against your customers is legal. Stealing someones ability to make a living is completely legal. In Canada, the company broke no laws. They did, however make a customer despise the company to the point where they cannot wait to get out of the financing and deal with a company which has respect for the people that pay them.

Keep away from Trend Financial at all costs, unless you enjoy wasting thousands of dollars in administration fees and want to take your life in your hands by driving an unsafe, unfit vehicle simply to suit their fancy. Trend Financial is on the lowest rung of the financing world. Slightly above loan sharks that break your legs if you can’t pay. They are unscrupulous, unfair, uneducated, and will do everything in their power to take your money and provide you with nothing but headaches and an empty wallet.

APRIL 3, 2016 UPDATE: Since publishing this article the truck has had a significant amount of breakdowns and cost thousands upon thousands of dollars to repair. This includes (But not limited to):

– Transmission temperature sensor (and associated costs including transmission oil, pan seal, filter, etc.)

– Front drive shaft

– Front tyres

– Cruise control motor assembly

– Manifold seals on both sides

– Valve cover seals on both sides,

– Front wheel bearing

– Two new batteries

2018 Repairs UPDATE: The vehicle had required new brakes, callipers,starter, starter wiring, and several thousand dollars of other random repairs.

June 5, 2018 – The vehicle has been paid off and sold. I am finally free from worst customer experience I have had in over 30 years. I have never had a company work so hard to make their paying customers miserable.

Barefoot Bushcraft acknowledges the land on which we gather was the historic territory of the Haudenosaunee and Anishinaabe peoples, many of whom continue to live and work here today. This territory is covered by the Upper Canada Treaties and is within the land protected by the Dish With One Spoon Wampum agreement. Today this gathering place is home to many First Nations, Métis, and Inuit peoples and acknowledging reminds us that our great standard of living is directly related to the resources and friendship of Indigenous peoples.

Error: Contact form not found.

Error: Contact form not found.

Error: Contact form not found.

Error: Contact form not found.

Error: Contact form not found.

Error: Contact form not found.

Error: Contact form not found.

Error: Contact form not found.